Q & A with CEO, Andrew Hochberg

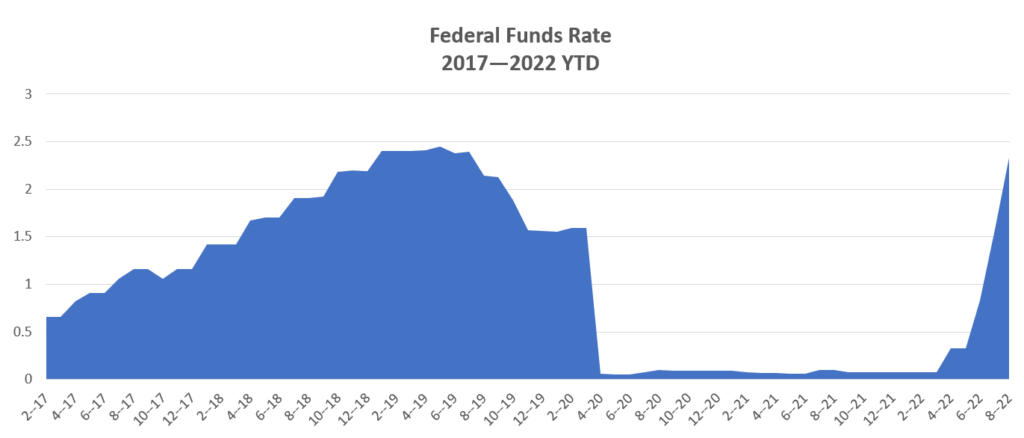

In less than six months, The Fed has made four 75 basis point rate increases including the most recent hike on November 2, 2022. There is speculation that another rate hike of as much as 75 basis points could occur before the end of the year. These measures have been taken with the goal of curbing the current inflationary climate and slowing the economy to a more acceptable level.

A number of our investors have raised questions concerning what has been, or what will be, the impact of higher interest rates on our current portfolio–as well as on our investment strategy moving forward.

The interest rate roller coaster certainly has been an interesting ride, as the graphic above demonstrates. The team at Next Realty continually monitors, debates, and anticipates the impact of interest rates on our ability to execute the business plans for each asset and produce appropriate returns to investors. We have similar discussions on the impact of interest rate movement on our acquisition and disposition strategies. We are confident that Next Realty is well-positioned for success in this current economic climate.

Below are responses to three of the most commonly asked questions:

How does the increase in interest rates affect your current portfolio?

Interest rate increases are challenging to short-term, variable rate financing. This type of financing is typically used in projects where 1) the business plan is short-term in nature, 2) significant redevelopment or renovation occurs relatively quickly and 3) long-term financing isn’t available because of the asset class and/or tenant credit quality. While most of our portfolio financing is fixed long-term, an example of this short-term variable rate financing in our current portfolio is a recent acquisition of a vacant former bank building in Barrington, IL where we will be executing a value-add business plan in the short-term.

While the rate increases are unwelcome because they add to our cost, a 100-300 basis point change in short-term interest rates does not generally endanger the business plans and long-term success of our investments. It is important to remember that the current inflationary climate, and an effort to slow down the economy, is a rationale for the rate increases. In many cases, we have seen revenue increases, through annual rental rate escalations, from inflation that offset the interest rate increases.

Long-term rates have had a less significant impact move as the 10-year Treasury rate spiked and then returned to a more normalized point. In any case, most of our larger loans are fixed and we are not impacted by moves in short-term rates.

How does the increase in rates affect our valuations?

The valuation of our investments is a complicated process involving current income, length of leases, and many other factors.

The most commonly used valuation in commercial real estate is a cap rate methodology where the value is equal to the income divided by a percentage rate. For example, $1,000,000 of income at 5% cap rate equates to a value of $20,000,000 (or $1,000,000/.05). So as rates increase, values decline as with any fixed income investment.

Because our Multi-Solution™ Strategy stresses diversification, we are well-positioned for this environment as very few of our income streams are fixed. Our residential rents, small shopping center leases, and parking rates can be increased periodically. Therefore, changes to valuations are hard to determine due to factors mentioned above and the substantial liquidity that exists, and will likely remain, in the marketplace.

How do the rate changes affect your view on acquisitions?

The recent rate increases have not affected our objective to be net buyers in 2022. At the present time, the rate increases may be creating more challenges to acquisitions than opportunities. Rapidly changing economic conditions often create significant discrepancies in the bid-ask spread—the price expectations between sellers and buyers. Typically, sellers believe rates will go down and therefore values will go up. In contrast, buyers have to consider a number of new factors including inflation, rate hikes, recession, and remodeling costs. Hence the widening of the gap. We believe it will take time for this gap between sellers and buyers to narrow.

As always, we will remain patient and agile as we look to identify and assess opportunities to create a diversified, risk-adjusted portfolio for our investor group.